ONCE AGAIN BLOOD...!!!

BUT THANK YOU VERY MUCH TO ALL BEARS...!!!

CONCLUSION SHARED IN OUR LAST BLOG POST WAS AS UNDER:-

FROM 21/10/2018 WE ARE GOING TO START COMBO WORKSHOP ON TECHNICAL ANALYSIS AS WELL AS OPTION TRADING. INCASE IF YOU HAVE ANY QUERY PLEASE CLICK HERE TO JOIN OUR WHATSAPP GROUP OR INCASE IF YOU WANT TO CONTACT US DIRECTLY CALL 08866145155/09067750730 OR DROP MAIL ON NIFTY50STRIKER@GMAIL.COM

BUT THANK YOU VERY MUCH TO ALL BEARS...!!!

CONCLUSION SHARED IN OUR LAST BLOG POST WAS AS UNDER:-

FROM 21/10/2018 WE ARE GOING TO START COMBO WORKSHOP ON TECHNICAL ANALYSIS AS WELL AS OPTION TRADING. INCASE IF YOU HAVE ANY QUERY PLEASE CLICK HERE TO JOIN OUR WHATSAPP GROUP OR INCASE IF YOU WANT TO CONTACT US DIRECTLY CALL 08866145155/09067750730 OR DROP MAIL ON NIFTY50STRIKER@GMAIL.COM

WE ARE GOING TO CONDUCT FREE WEBINAR ON DEMAND & SUPPLY ZONE ON SATURDAY TO REGISTER CLICK HERE

Nifty Spot Closed with 259 points Loss at 10599 whereas Nifty Future (October Series) closed at 10631 (Premium of 32 Points)

Nifty Bank Closed with 297 points Loss at 24819 whereas Bank Nifty Future (October Series) closed at 24862 (Premium of 43 Points)

Nifty View

Now for next trading session important Resistance & Support Levels (Spot basis) are as under:-

Resistance zones ~ 10615-10650-10690-10715-10740-10785-10815-10840-10870-10895-10940-10980-11020-11045-11070-11100-11125-11150-11170-11185-11210-11275-11235-11330-11360-11300-11385-11410-11425-11425-11435-11470-11495-11525-11550-11565-11585-11605-11620-11655-11690-11710-11725-11735-11750-11900-11920 (zone as per higher time-frames)

Support ~ 10585-10555-10525-10500-10460

CONCLUSION

10850-10870 IF PROTECTED BY BULLS WE CAN SE SOME BOUNCE ELSE SUB 10800 LEVELS CANNOT BE RULED OUT FOR NIFTY FUTURE IN NEXT SESSION. (PREVIOUS BLOG POST CONCLUSION)

Now we feel that one more fall till 10500-10520 can be seen in next 2 sessions.

Nifty Bank View

Now for next trading session important Resistance & Support Levels (Spot basis) are as under:-

Support ~ 10585-10555-10525-10500-10460

CONCLUSION

10850-10870 IF PROTECTED BY BULLS WE CAN SE SOME BOUNCE ELSE SUB 10800 LEVELS CANNOT BE RULED OUT FOR NIFTY FUTURE IN NEXT SESSION. (PREVIOUS BLOG POST CONCLUSION)

Now we feel that one more fall till 10500-10520 can be seen in next 2 sessions.

Nifty Bank View

Now for next trading session important Resistance & Support Levels (Spot basis) are as under:-

Resistance Zone ~ 25065-25150-25220-25340-25455-25650-25455-25340-25220-25150-2577525065-25810-25920-25985-26015-26070-26170-26255-26285-26325-26410-26450-26520-26615-26650-26695-26765-26805-26900-26970-27045-27145-27230-27335-27405-27470-27600-27640-27680-27720-27790-27825-27845-27890-27940-27970-28060-28130-28175-28210-28265-28320-28375-28320-28375

Support ~ 24810-24680-24515-24380-24250-24150-24085-24010-23930-23810-23740

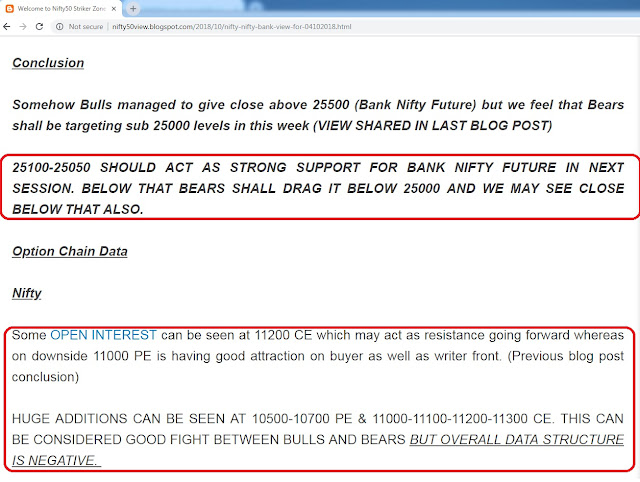

Conclusion

25100-25050 SHOULD ACT AS STRONG SUPPORT FOR BANK NIFTY FUTURE IN NEXT SESSION. BELOW THAT BEARS SHALL DRAG IT BELOW 25000 AND WE MAY SEE CLOSE BELOW THAT ALSO. (VIEW SHARED IN LAST BLOG POST)

24500 SHALL ACT AS STRONG SUPPORT IN NEXT SESSION.

Option Chain Data

Nifty

Mammoth OPEN INTEREST addition can be seen on 10400-10500-10600-10700 PE front. Where as on CE front right now 10600-10700-10800-10900-11000 CE front.

Once final leg of fall is due till 10500-10550 as per Option Chain data.

Nifty Bank

Weekly Option Chain

OPEN INTEREST Built-up yet to take place for any conclusion as per current market scenario.

Monthly Option Chain

25500 CE OPEN INTEREST resistance going forward. Good attraction can be seen in 24500 PE strike as well. Now going forward all hopes are on 24000 PE for further fall.

--------------------------------------------------------------------------------------------------------------------------

YOUTUBE CHANNEL

FOR LIVE MARKET UPDATE & FREE OPTION CALLS JOIN:-

--------------------------------------------------------------------------------------------------------------------------

T.ME/NIFTY50STRIKER

--------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------

SOCIAL MEDIA TOUCH POINTS:-

IN CASE OF ANY QUERY/SUGGESTIONS READERS ARE REQUESTED TO CONTACT US NIFTY50STRIKER@GMAIL.COM OR 08866145155

Please note this blog post is for education purpose only. While utmost care is taken while writing this post but any human error cant be ruled out and we apologize for same in advance.

--------------------------------------------------------------------------------------------------------------------------

No comments:

Post a Comment

Note: only a member of this blog may post a comment.